It is increasingly common to hear about restructuring operations and, in particular, the so-called spin-off operations, but what is a spin-off? And when is it advisable to carry out this type of operation?

Throughout this article, we will analyse the so-called spin-off operations in order to gain a deeper understanding of them, as well as the causes that could lead to this type of restructuring operation.

1. What is a spin-off operation?

A demerger can be defined as an operation whereby the divides all or part of a company's assets in order to transferwithout liquidation, the resulting share to other pre-existing companies or companies created for this purpose.

2. Types of division

There are different modalities of excision:

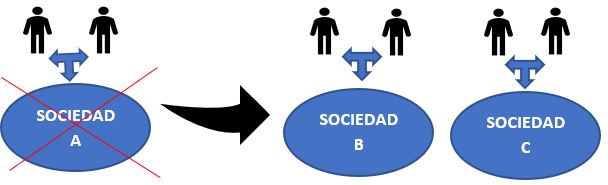

Total excision:

In this case, the termination of the company by the division of its assets into two or more partseach of which is transmitted en bloc by universal successionl to a existing or newly created company, the partners receive a number of shares or holdings in the beneficiary companies in proportion to their holdings in the splinter society.

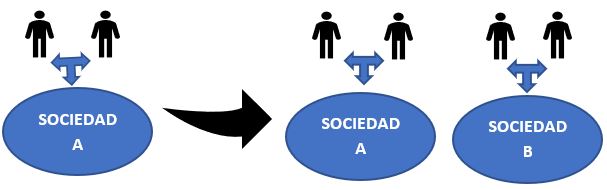

Partial excision:

The transfer en bloc by universal succession of one or more parts of the assets and liabilities of a company, each of which forms an economic unit, a one or more newly created or already existing companiesreceiving the shareholders of the company being spun off a number of shares in the receiving companies of the split proportional to their respective participation in the split-off company y by reducing the share capital by the necessary amount.

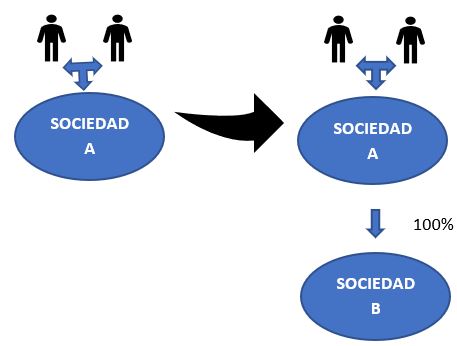

Segregation

It is the en bloc transfer by universal succession from one or more parts of a company's assets, each of which forms an economic unit, a one or more companies, receiving in return the hived-off company shares/participations of the beneficiary companies.

3) Reasons for division

There are numerous reasons and circumstances that may lead a company to carry out a demerger, however, some of the most common could be listed below:

There are numerous reasons and circumstances that may lead a company to carry out a demerger, however, some of the most common could be listed below:

1.Strategic decisions which entail the separation of the different branches of activity of a company in order to:

- Having a further specialisation of each of the resulting companies.

- Diversifying risksThe assets of, for example, a particular activity in a company are not liable for other activities of that company.

- Implementing better policies in each of the branches (i.e. commercial, business policies, etc.).

- Decentralising secondary activities.

- Separate cash flows and improve investments per business line or activity.

- Optimising profitability of each activity.

- More rational organisational structure to allow for more independent, autonomous and professional management of the various branches of activity.

2. Reducing the economic dimensions to eliminate interference, e.g. from the complexity of running a large company

3. Serious disagreements or disagreements between partners (i.e. conflicting heirs or founders).

4. Facilitating the entry of new partners in one of the company's branches of activity.

5. Escape from certain legal provisions related to the size of the company.

4) The special tax scheme: existence of a valid economic ground

In addition, in order to be able to apply the special tax regime of Chapter VII of Title VII of the Corporate Income Tax Act, as we have already seen in our previous postsIn this case, there needs to be a valid economic business reason other than tax savings.

In particular, Article 89.2 of the SI Act provides that ".The arrangements provided for in this Chapter shall not apply where the main purpose of the transaction carried out is tax evasion or tax avoidance.".

In short, this requires that the vehicle giving rise to the restructuring be a valid economic reason, such as those mentioned above, and never merely for the purpose of obtaining a tax advantage.

In short, as the Directorate General for Taxation frequently points out in binding consultations ".The rationale of the scheme is that taxation should be neither a brake nor an incentive for companies to take decisions on reorganisation operationswhere the cause for doing so is based on valid economic motives, in which case taxation is intended to play a neutral role".

5) Tax requirements of the division

There are two ways of applying the special tax regime to a demerger operation:

- Carrying out a total division in which the assets of the spun-off company must be divided proportionally (without having to correspond to the branch of activity) and shares must be attributed to the shareholders in the new acquiring companies on a proportional basis. This is known as proportional full excision.

However, if a company is completely split up and the shareholders are allocated shares in the new companies on a non-proportional basis, this would be a situation of non-proportional full demerger that cannot benefit from the tax neutrality regime.

This would occur, for example, in the case of the spin-off of a company with a single activity (i.e. the rental of real estate) and which intends to attribute the assets to two new companies (which will carry out the same activity as the spun-off entity) and assign to each partner shares in only one of the spun-off entities. This would be a total non-proportional spin-off which would not be able to apply the special tax regime.

- Or make a partial excision which need not necessarily be proportional and which requires splitting by branch of activity.

In this case, as the company's assets are divided into branches of activity, the tax system does allow shares to be attributed to the shareholders on a basis that is not proportional to what would have corresponded in accordance with the shareholding in the company being spun off. This would be a non-proportional partial spin-off.

These methods of demerger meet a "proportionality" standard, which can be of two kinds:

- Quantitative proportionalityIt implies that the proportion should be set according to the real value of the respective assets and liabilities of the company being spun-off and the recipient companies, so that the shareholder of the spun-off entity should receive shares in all recipient companies equal to the real economic value of its shareholding being spun-off.

- Qualitative proportionalityIt implies that the partners of the spun-off company must receive the same proportion of shares in the beneficiary companies as they had in the capital of the spun-off company.

It is only when both proportionalities meet that we have a full proportional split. However, in 2019, the European Commission called on Spain to amend the internal implementation of the tax regime to bring it into line with Directive 2009/133/EC. and allow that the division can be carried out according to a "proportional rule" which can only be quantitative.

6) VAT implications of the split-off

Although the special tax regime may be applicable to the spin-off operation (even if there is no branch of activity), it is important to note that for the spin-off operation not to be subject to VAT, the part being divided must constitute an "autonomous economic unit".This concept does not necessarily coincide with that of branch of activity.

In order for an autonomous economic unit to exist within the meaning of Article 7 of the VAT Act, there must be an set of corporeal and incorporeal elements which form part of the business assets of the taxable person, provided that "....constitute an autonomous economic unit capable of engaging in a business or professional activity by its own means".

Therefore, the taxation of the spin-off for VAT purposes and for corporate income tax or personal income tax purposes must be analysed separately, depending on the status of the shareholder.

In any case, it is always advisable for the company to seek advice and carry out an in-depth legal and tax analysis before undertaking such complex transactions, in order to avoid problems in the future.

At MERAC legal & tax lawyers we have extensive experience in this type of transactions should you require advice in this respect.

One Response