Restructuring operations are sometimes approached in a way that ignores the tax implications or on the assumption that no tax will accrue. However, special care must be taken with this assumption, because the tax implications exist and they can be very large. They can also be the reason why a restructuring operation has to be structured in a certain way or, worse, cannot be carried out at all.

Regulation of the tax neutrality regime or special tax regime

The regime is formally known as the "Special regime for mergers, spin-offs, contributions of assets, exchange of securities and change of registered office" and is regulated in Chapter VII of Title VII of Law 27/2014 on Corporate Income Tax (Ley IS).

To which corporate restructuring operations does the scheme apply?

This regime is applicable to a number of mergers and acquisitions, as restructuring or "M&A" transactions are generally known (Mergers & acquisitions).

In general, we can talk about:

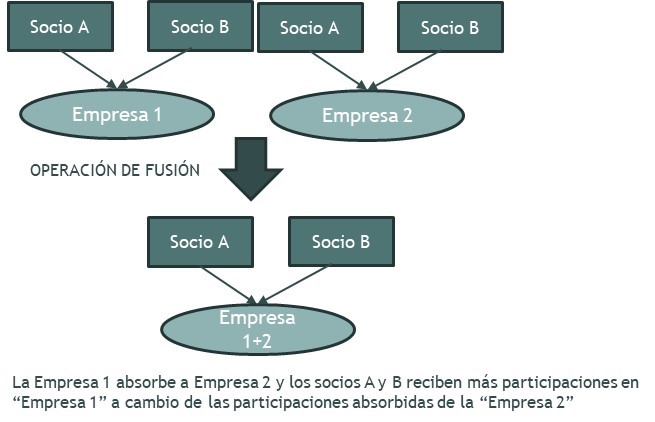

1) Merger

This is the operation whereby one company (or several companies) transfers all its assets and liabilities en bloc to another existing company. In exchange, the shareholders of the absorbed entity are attributed shares in the share capital of the absorbing entity (which may be compensated in cash up to 10% of the nominal value).

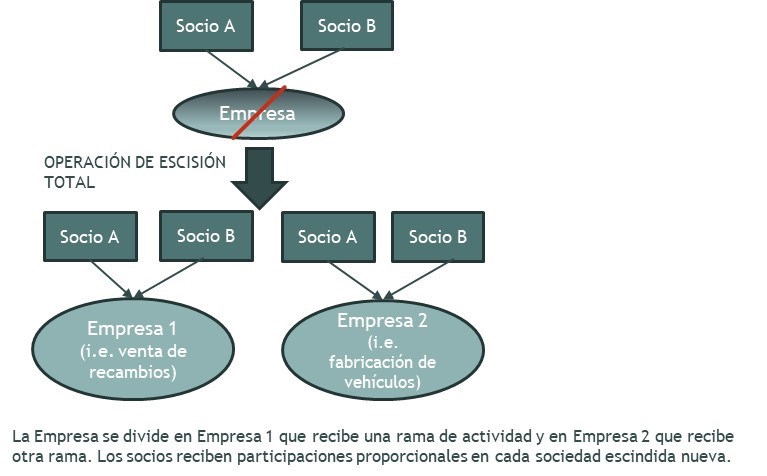

2) Splitting

We could speak of two alternative ways of splitting:

- The total divisionwhich must be proportionate, whereby an entity divides all of its equity into two or more parts and passes them on to two or more existing or new entities, while the breakaway company disappears. In this case, the partners will participate proportionally in each company acquiring the assets.

- The partial division whereby a company divides its assets into branches of activity (which need not necessarily be proportional) and passes them on to other existing or new entities, and holding one of the branches of activity in its assets. In this case, where we would be dealing with a non-proportional split, the partners may participate proportionally in each new partnership and in the original one split-off or to allocate shares to each other in different proportions to the one they had in the split-off company.

These two demerger alternatives are particularly relevant in the case of real estate companies. It is often the case that family businesses whose main activity is the rental of real estate and whose partners want to divide the company's assets in order to be able to separate the management and management of the company, consider the alternative of a spin-off.

It is very important to ascertain whether there are different branches of activity (e.g. property rental and property development) which would allow a partial spin-off to be carried out or, on the contrary, the entity to be spun off has only one activity (e.g. property rental) in which case, the spin-off must necessarily be total and the new shares must be distributed among the partners in proportion to the shares of the spun-off entity, whereby both partners would continue to have a stake in each of the spun-off entities.

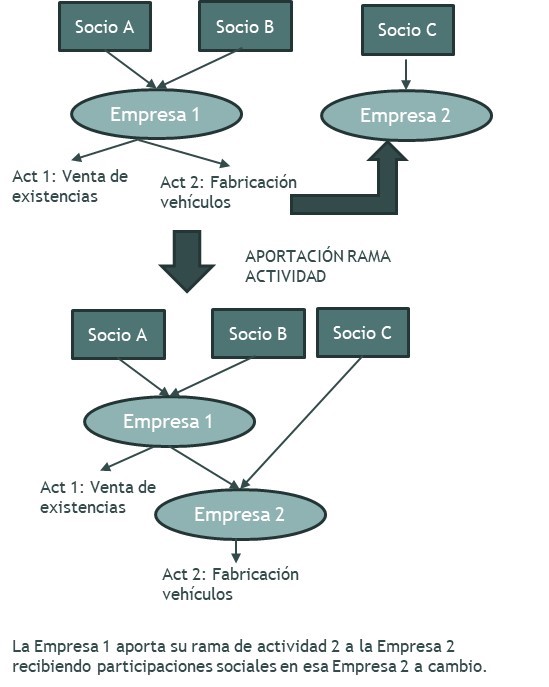

3) Non-monetary contribution

Operation whereby an entity, which is not dissolved, contributes an asset, right or branch of activity to another existing or new entity[1]in return for which they will receive participations of the share capital of the entity receiving the business line.

This operation is instrumented as a capital increase operation of an entity, which is subscribed by another company by contributing an asset (e.g. real estate, machinery, etc.) or a branch of activity of its assets to the capital increase.

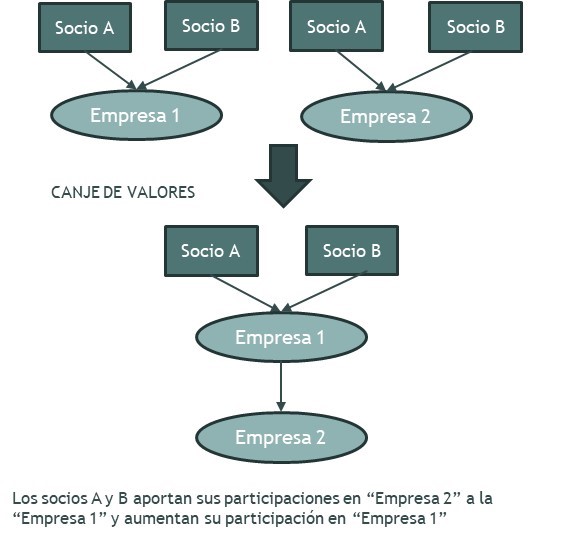

4) Exchange of securities

A swap transaction is considered to be a transaction by which one company acquires equity in another company and, in return, delivers equity in another company.

In practical terms, this would be a kind of exchange of shares between companies.

5) Change of registered office

A change of registered office outside Spain is equivalent for tax purposes to a transfer of assets to a non-resident company.

However, in the event that the Spanish entity that transfers its domicile to another Member State assigns its assets and rights in Spain to a permanent establishment in Spain, this tax neutrality regime may be applied.

What is the special tax regime?

The special tax regime gives rise to:

1) Deferral of taxation

In all the aforementioned transactions, we are dealing with a transfer of assets to another company, so that, strictly speaking, income would be generated by these transactions.

However, this regime allows such income not to be taxed and not to be included in the taxable income of the transferring entityThe taxation is deferred to a later point in time, so that the taxation of these transactions can be deferred to a later point in time, so that the taxation of these transactions can be deferred to a later point in time.

Similarly, no income accrues to the shareholders of the transferring entities when acquiring shares in the new entities.

For this reason, where the special regime applies, for the acquiring entity:

- Assets and rights received from restructuring operations is valued, for tax purposes, at the same value that he had in the entity that passed it on to him.

- In the same way, these goods and rights maintain, for tax purposes, the date of acquisition as the date of acquisition. the one they had in the transferring entities.

- In the case of mergers and divisions, the following shall be taken into account tax value of the delivered

This only goes to show that we are, in fact, in a situation where we are The tax deferral regime and not the exemption regime, which effectively postpones taxation to a future point in time.The acquiring company receives the assets and rights with the same value and date of acquisition as they had in the transferring company.

2) Subrogation of rights and obligations

In cases where restructuring operations result in a universal succession, the acquiring institution is subrogated to all rights and obligations (taxation) of the transferring entity (e.g. in a merger).

When the succession other than by universal successionare transferred to the acquiring entity the tax rights and obligations relating to the transferred assets and rights (e.g. in the non-cash contribution of a branch of activity).

Among other things, this obliges the acquiring entity to assume the obligation to comply with the requirements of the regulations in order to apply certain tax benefits and/or to make adjustments for temporary differences applied by the transferor.

The "automatic" application of the special tax regime

Prior to the reform that entered into force on 1 January 2015, the taxpayer had to expressly opt for the application of this special tax regime or else the restructuring operation would be taxed.

Since 2015, the tax regime applies automaticallyThe taxpayer may waive its application by including the income generated in the tax base.

Formal obligations

The application of the special tax regime requires the fulfilment of a number of formal obligations that must be carried out.

Specifically:

- The acquiring entity must include a mention in the Annual Report of the Annual Accounts of the year of the approval of the restructuring operation, including information on the assets acquired, applicable tax benefits, etc. Subsequent years may include the same mention or indicate that they were included in that first report.

- In addition, the acquiring entity must make a formal communication to the AEAT Delegation of the tax domicile of the entities, within 3 months from the registration of the public deed documenting the transaction or from the execution of the deed if registration is not necessary.

It should describe the transaction, identify the parties involved, inform if the special tax regime is not applicable and, additionally, attach a copy of the deed documenting the transaction.

Existence of Valid Economic Ground

However, even if all of the above requirements could be met, it is essential that the operation has a valid economic motive other than purely fiscal..

In particular, Article 89.2 of the SI Act provides that ".The arrangements provided for in this Chapter shall not apply where the main purpose of the transaction carried out is tax evasion or tax avoidance.".

This requires that the vehicle motivating the restructuring be valid economic reasons, such as restructuring or rationalisation of the activities of the entities involved, and never merely for the purpose of obtaining a tax advantage.

In short, as the Directorate General for Taxation has stated in numerous consultations "...".The rationale of the scheme is that taxation should be neither a brake nor an incentive for companies to take decisions on reorganisation operationswhere the cause for doing so is based on valid economic motives, in which case taxation is intended to play a neutral role".

In future posts we will discuss the implications of these restructuring operations for other taxes.

(1) For corporate income tax purposes, a branch of activity is defined as a group of assets and liabilities which are capable of constituting an autonomous economic unit determining an economic operation, i.e. a group capable of operating by its own means. In line with this definition, it is possible to transfer within the branch of activity the debts incurred for the organisation or operation of the assets being transferred.