Actualmente es muy habitual encontrar en el mundo empresarial empresas que funcionan bajo la estructura del holding empresarial, But what exactly is this figure? And when is it advisable to set it up and implement it?

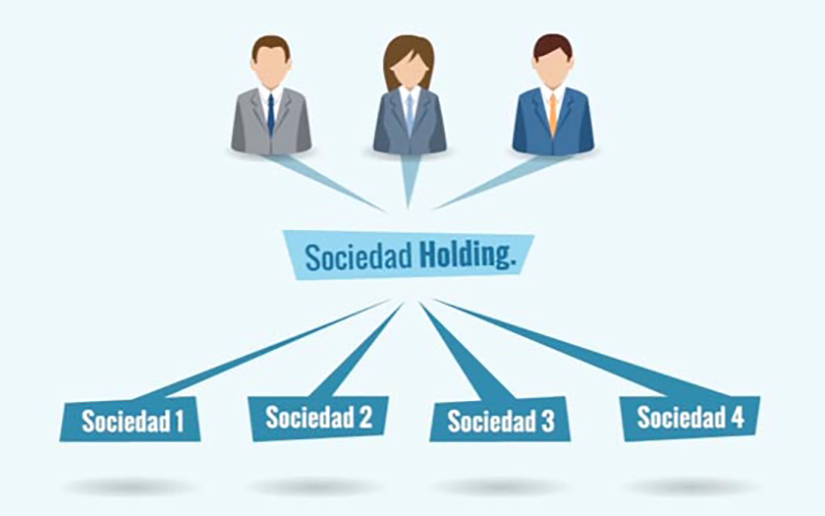

Below we explain what the Holding structure consists of and in this video we summarise it for you.

What is a holding company or holding company?

The holding empresarial o holding company could be defined as a holding company whose activity is the holding of shares in other companies for the purpose of directing and managing such shares. ywhere appropriate, the activity carried out by them on a centralised basis.

If we analyse the business fabric of our country, it is very common to find companies whose partners participate directly in other companies with different activities, or companies in which, due to their growth, they have developed different activities within the same company. For example, companies that, in addition to their main activity, have acquired properties that they are using for real estate activities, all under the same corporate umbrella.

This situation can lead to a confusion of risks between the different activities, as well as to inefficiency both at the level of business management and from a tax point of view.

Por ello, en estos casos, además de separar las actividades por sociedades, puede resultar muy beneficioso la constitución de una holding company, a la que los socios personas físicas aportarían sus participaciones en las sociedades, de forma que éstos quedarían como socios de la holding company y, ésta a su vez como socia del resto de las compañías.

Pero, ¿Cuáles son las ventajas empresariales de crear un holding empresarial?

Although the advantages may be multiple and each case would have to be analysed individually to determine whether or not it is advisable to set it up, we can broadly highlight the following advantages:

- Permite dirigir las empresas del grupo de forma centralizada desde la sociedad holding.

- Providing services to subsidiary companies from the holding company, taking advantage of economies of scale.

- Segmenting debt and corporate finance by compartmentalising risksThe aim is to prevent assets assigned to one activity from being liable for the results of other activities.

- Facilitating investment in new businesses/subsidiaries financiándolos con el beneficio obtenido por el resto de entidades participadas, ya sea mediante ampliación de capital de la holding company o mediante préstamos de ésta a su nueva filial.

Ventajas fiscales de una empresa de Holding

Además, desde un punto de vista fiscal, existen diversas ventajas al tener una sociedad holding, que a continuación mencionamos:

- Enables the reinvestment of company profits without entailing a high fiscal cost for the partners.

It is one of the main tax benefits when these structures are in place. The dividends received by the holding company from its subsidiaries are in most cases exempt under 95%.This allows dividends to be paid out at virtually no tax cost and to be able to re-invest profits business in the company's new investments or in other affiliated entities through loans or capital increases, at almost no tax cost.

However, when the partner of the company is an individual, he or she will be taxed on dividends at an incremental scale of between 19%-26% depending on the amount, which is a high tax burden for those who want to use these funds for new business investments.

In a numerical example, faced with a dividend of 100,000 eurosa natural person would pay personal income tax the amount of €21,880, which results in an effective tax rate of 21,88%, while if it is the holding company who receives it with the right to apply the exemption of 95%, would pay an amount of taxes of 1.250 €.The difference is even greater the higher the dividend is.

- In case of sale of one of the companiesThe tax burden, e.g. for the entry of a third party investor, is low.

If the direct shareholder is an individual, he/she would be taxed on the profit obtained at the same rates as dividends. However, in the case of a holding company, the profit from such a sale would qualify for the 95% exemption. provided for in Article 21 of the Corporate Income Tax Act, as it is received by a company and not by an individual shareholder.

The difference in amount would be the same as for dividends.

- Possibility to opt in to the tax consolidation regime.

This system makes it possible to consolidate the tax bases of the different companies and to offset the negative results of some companies against the profits obtained by others.

- Reducing the tax burden in the succession of partners natural personsas well as facilitating the implementation of the exemption from Wealth Tax.

The holding structure makes it easier to meet the requirements to apply thehe Wealth Tax Exemption only in this entity.

In addition, both in the case of inheritance as gifts, would facilitate the application of the 95% reduction for family business succession.. Moreover, in the case of a donation, applying this reduction would allow the donor's personal income tax gain to be exempt.

Conclusiones de una sociedad holding

In the event that there were various partnerships owned by natural person partners, could prove to be it is advisable to study the advantages of setting up a holding company that allows for a number of benefits to be obtainedThis is a key element in the development of the business, both from a business management point of view and from a fiscal point of view, as well as a diversification of the risks associated with each of the activities carried out, which will ensure the continuity of the different businesses.