When a company comes to the end of its life it is common for partners to wonder whether liquidating the company has any tax implications. The answer is yes, there are a number of taxes that are due and may involve a high amount of tax to be paid especially if the entity has high value assets, such as real estate or cash, to be distributed among the members.

Por ello, es recomendable contar con el asesoramiento de abogados en Mijas o abogados en Benalmádena que conozcan bien la fiscalidad local.

Furthermore, it is important to bear in mind that in order to liquidate the company, no debts may remain owed to third parties other than the shareholders, or the notary public will most likely not allow the public deed of liquidation to be granted.

If there are still debts owed to third parties, the only option to liquidate the entity is to initiate voluntary insolvency proceedings.

Taxation of the company to be liquidated - Corporation tax.

a) Market valuation of assets.

En primer lugar, debe advertirse que en el presente post vamos a analizar la disolución de una empresa con liquidación, que difiere de aquellos casos, como por ejemplo en una fusión, en el que se produce la disolución de la entidad sin liquidación. Si te encuentras en esta situación, contar con el asesoramiento de abogados en Málaga especializados en derecho mercantil puede resultar fundamental para garantizar un proceso correcto y conforme a la normativa vigente.

Pursuant to Article 17.4.c) of the Corporate Income Tax Act, it regulates that assets and liabilities " shall be valued at market value " shall be valued at market value.transferred to the shareholders on dissolution, separation of the latter, reduction of the capital with return of contributions, distribution of the share premium and distribution of profits".

It adds in paragraph 5 that "the transferring entity shall include in its taxable base the difference between the market value of the transferred items and their tax value."

This means that if, for example, the company owns real estate that was acquired several years before the dissolution of the company, shall be obliged to revalue it for accounting purposes at current market value prior to liquidation..

This revaluation gives rise to accounting income to be taxed at 25%.

b) No limitation on the application of tax losses.

Corporate income tax legislation establishes a general limitation on the application of tax losses pending application of the 70% of the previous tax base [1]1 million, with a minimum amount of EUR 1 million.

However, This limit does not apply to the period in which the liquidation of the company takes place.

This may mean that, despite having to update the asset values to the real value and giving rise to a profit for the company that is taxable, if the entity has outstanding negative bases, it could apply them without limit and thus reduce or neutralise the tax burden arising from the revaluation of the assets.

(c) Current account with members and other items.

As indicated above, it is possible to liquidate an entity that has debts with shareholders, although it is usually advisable to settle and offset, as far as possible, debtor and creditor accounts with shareholders before liquidation is carried out.

Moreover, it is important to bear in mind that if the credit is written off for accounting purposes against the shareholder without any consideration whatsoever, it could be understood for tax purposes as a donation in favour of the shareholder, which would give rise to double taxation: (i) on the one hand, the shareholder would receive taxable income and (ii) on the other hand, the subsidiary that waives the debt would incur a non-deductible tax expense.

Transfer Tax - Corporate Transactions

Once the liquidation balance sheet of the entity is available, which reflects the assets and liabilities of the company at the end of its life, a distribution of these assets and rights must be carried out in favour of each shareholder, in proportion to their percentage share in the share capital of the entity to be liquidated.

This allotment of the liquidation share shall be reflected in the deed of liquidation to be granted.

On the occasion of the liquidation of the entity, the tax on the transfer of property for valuable consideration, in the form of corporate transactions, is payableThe taxable event is defined as "...".the dissolution of companies".

In this case, the taxable amount shall coincide with the "the real value of the assets and rights delivered to the partners, without deduction of expenses and debts", the taxable persons being the partners who receive such goods.

Since the assets of the dissolved entity will have been updated to real value prior to the granting of the deed of liquidation, the tax base will coincide with the liquidation quota assigned to each member.

Y, the resulting tax liability shall be equal to 1% of this settlement share.

Taxation of partners

On the other hand, the liquidation of the entity will also give rise to a capital gain or loss for the partners, whether they are individuals or legal entities.

A) Partners who are natural persons.

When the partners are natural persons, a fee would be payable for capital gain or loss for the difference between the amount contributed at the time by the latter and the amount contributed by the former. (either the share capital paid up at the time or the price paid if the shares were acquired) and the value of the goods and rights they receive at the time of settlement.

This is regulated by Article 37.1.e), which states that

"In cases of separation of partners or dissolution of companies, the difference between the value of the share in the company's liquidation or the market value of the assets received and the acquisition value of the corresponding share or capital participation shall be considered as a capital gain or loss, without prejudice to those corresponding to the company.

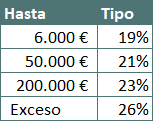

This capital gain or loss is included in the savings tax base and therefore the tax brackets are applied.

B) Partners who are legal persons.

In a similar way to what occurs in the case of the individual, a capital gain or loss would accrue in the legal entity for the difference between the value of the holding recorded in the balance sheet and the assets received on liquidation of the subsidiary, which must be included in its accounting profit or loss.

1) Book value of the portfolio vs. tax value of the portfolio.

In this case it is important to know that the book value of the holding may be different from the tax value of the holdingAs a result, it will be necessary to make the necessary off-balance sheet adjustments when preparing the corporate income tax return.

This could happen, for examplein the event that the participations would have been impaired for accounting purposes pero ese deterioro no hubiese resultado fiscalmente deducible en virtud del artículo 13 de la Ley IS. En un supuesto así, puede que exista un beneficio contable por la liquidación de la entidad pero que, sin embargo, exista una plusvalía fiscal

Example:

Let us imagine that the entity incorporated a subsidiary with a capital contribution of €300,000. In 2018, due to accumulated losses, the entity impaired the portfolio by €200,000, although this impairment was not deductible for tax purposes, giving rise to a positive off-balance sheet adjustment.

Consequently, while the book value of the portfolio is €100,000, the tax value of the portfolio is still €300,000.

In 2020, the entity decides to liquidate the subsidiary and obtains €150,000 worth of assets and rights as a liquidation proceeds. When the liquidation accounting entry is recorded, an accounting gain is recorded for the difference between the book value of the portfolio (€100,000) and the assets received on liquidation (€150,000).

However, for tax purposes, as the value of the portfolio was still €300,000, on receiving goods and rights for €150,000, a tax loss of €150,000 (€300,000 - €150,000) will have arisen. This will give rise to a negative off-balance sheet adjustment as this is when the loss is fiscally "realised" and becomes tax deductible in 2020.

2) Exempt capital gains and deductible negative income.

Furthermore, it should be borne in mind that if a capital gain/profit arises in the partner entity from the liquidation of the subsidiary entity, this may be exempted.[2] whether the requirements of Article 21 of the Corporation Tax Act are met, i.e., in summary:

- The direct or indirect shareholding in the subsidiary must be at least 5%.

- Such a shareholding must have been held continuously during the year preceding the day of liquidation.

- And, in the case of holdings in non-resident entities, that the investee has been subject to, and not exempt from, a tax analogous to corporation tax at a nominal rate of at least 10%.

And, in the event of a loss arising on liquidation of the subsidiary, Article 21.8 of the Tax Law expressly allows for the tax deductibility of that negative income when it arises from the liquidation of the entity.

"Negative income generated in the event of the extinction of the investee shall be tax deductible, unless the extinction is the result of a restructuring operation".

IIVTNU or municipal capital gains tax

Finally, we must not forget that if, on the occasion of the liquidation of the entity and the awarding of assets and rights to the members, real estate is transferred, the tax on the increase in value of urban land (IIVTNU), also known as municipal capital gains tax, may be payable. This tax should be paid by the entity liquidated as transferring entity.

Si necesitas asesoramiento legal para la liquidación de tu empresa o cualquier cuestión tributaria, no dudes en contactar con un abogado tributario Málaga para una atención especializada en derecho empresarial. También ofrecemos servicios en herencias y planificación sucesoria con un abogado herencias Marbella y asesoría en materia tributaria con un abogado fiscal Marbella, para garantizar que todas tus operaciones cumplen con la normativa vigente y optimizar tu carga fiscal.

Conclusions

As we have already mentioned, the liquidation of a company can give rise to various taxes, which can entail a significant tax burden that must be taken into account. For this reason, we always recommend that you carry out a prior tax analysis to avoid unnecessary risks and to reduce, if possible, the tax payable.

As a final example and as a summary of what has been analysed:

Let us assume an entity X that was set up by a natural person with a share capital of 70,000 euros.

The entity has a property worth €60,000 recorded as an asset, but its actual present value is €140,000 and cash of €5,000. In addition, the entity has €30,000 of tax loss carryforwards.

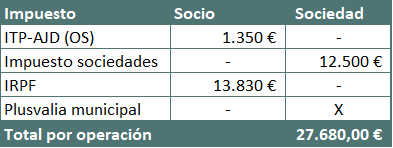

If the partner decides to liquidate the entity the taxes that would be as follows:

1- IS - Revaluation of assetsCompany X has to update the value of the property to €130,000 and will therefore record a profit of €80,000. As it has negative bases pending application of €30,000, it will have a taxable base of €50,000, which at the rate of 25% will be a tax liability of €12,500

2 -Company operationsThe natural person partner who will receive a property for 130.000 euros and cash for 5.000 euros will have to pay an amount of OS tax of 1.350 € (1% of the actual value of the goods and rights received)

3 - Capital gains for personal income tax purposes - The shareholder contributed €70,000 and on liquidation of company X receives €135,000, resulting in a capital gain of €65,000. In accordance with current tax rates, would result in a tax liability of 13,830 €.

4 - Municipal capital gains tax - and, additionally, this tax would be payable by the transferring liquidated company.

Notes:

[1] This limitation amounts to 50% when the net turnover is at least 20 million euros but less than 60 million euros. And, above 60 million euros of turnover, the limit is set at 25%, although always with a minimum amount of 1 million euros. (DA 15º)

[2] From 1/1/2021 a 5% handling fee applies, so the exemption, for practical purposes, is 95%.